Lutheran Services in America is currently seeking grassroots, faith-based organizations and initiatives affiliated with an ELCA church or community to join our 2023–2024 Results Network cohort, which starts September 28. Participation is free. The Results Network is a transformative opportunity for teams to advance racial equity for children and families in a high-support and high-accountability hybrid cohort experience. Participants work in fields as varied as child welfare, housing and economic empowerment, but are united by the goals of preventing or stabilizing families in crisis, strengthening communities and addressing racial disparities. Learn more about this opportunity and how to join.

Five years ago, I hit a wall professionally. I was exhausted by a four-year effort to transform an early childhood organization in Indiana and questioning my ability to lead teams. I did something that felt scary. With a second child on the way, I took a professional role with a lot less pay, but the flexibility to join a virtual cohort of changemakers I had long eyed as an opportunity to reinvigorate and refresh my purpose and my skills in advocacy and organizing.

The cohort, which was university-organized and crossed global boundaries, was a transformative experience that gave me the space to learn and safely practice new skills. One of my closest cohort relationships was with a young person working to create a new political party in Eastern Europe. We explored common challenges and solutions, despite our disparate focus areas. We provided each other candid, but empathetic coaching. I found my skill set growing exponentially, almost day-to-day. When the cohort ended, I used my new skills—and new energy—to grow a campaign to end smoking related death and illness in Indiana to 10,000 advocates.

Professional cohorts are amazing vehicles for change, in part because the act of joining one is motivated by courage. Courage to put yourself into a new and unfamiliar community. Courage to admit you need to grow professionally. Courage to explore what it means to move from the transactional (most of our day-to-day work, often by necessity) to the transformational.

I’m honored that Lutheran Services in America is host to the Results Network—a powerful annual cohort of child and family-serving organizations working toward transformative outcomes rooted in a focus on race equity.

In the past year, 41 Lutheran social ministry leaders across 10 U.S. communities took the courageous act of joining the Results Network and working through professional challenges. The results at the end of the year? Transformative change for over 8,300 children and families!

In coming together, participants in the Results Network—who work in teams of three—make the courageous commitment to:

- Be results-based and data-driven

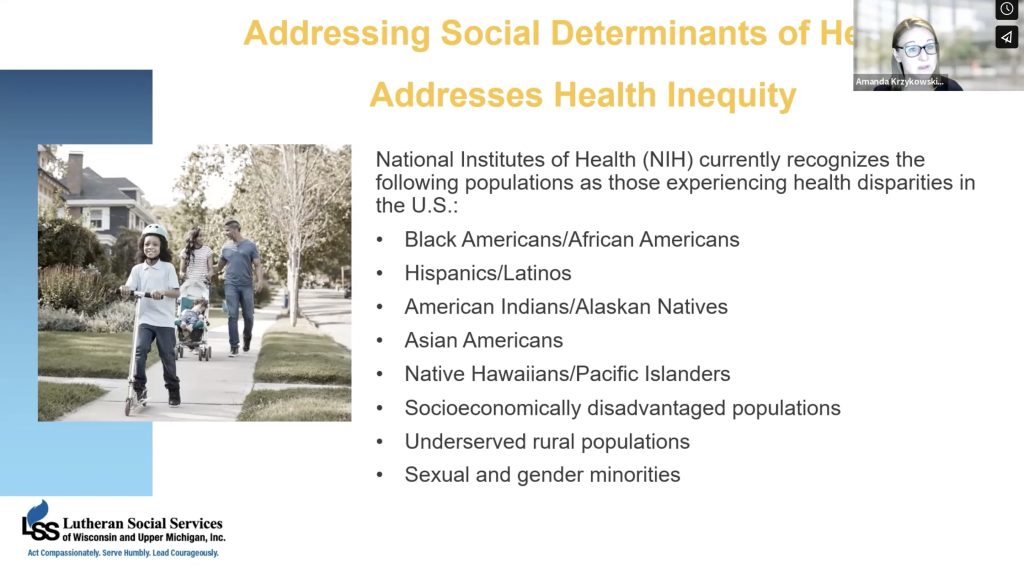

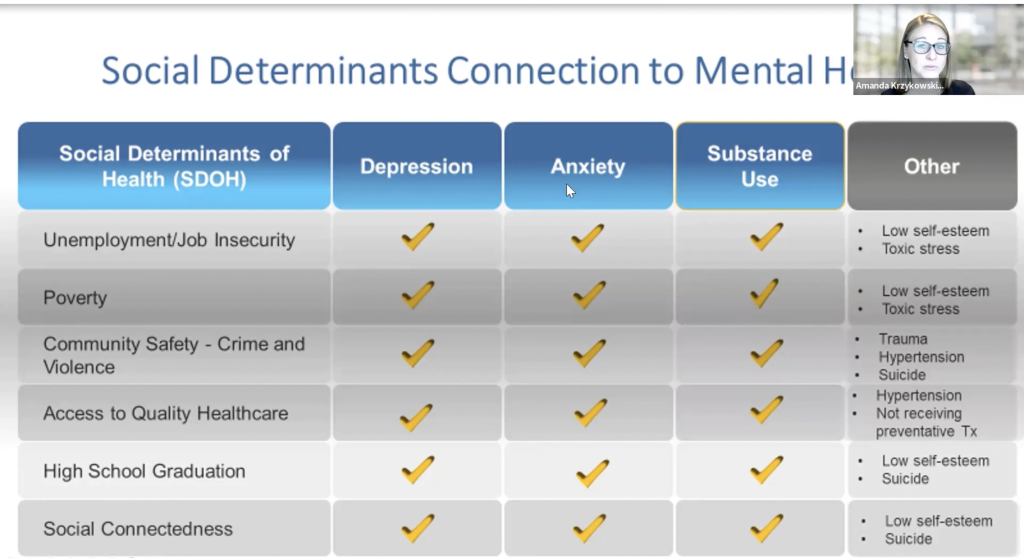

- Bring attention to and act on disparities

- Use oneself as an instrument of change to move a result

- Master the skills of adaptive leadership

- Collaborate with others

When these commitments are made and supported by the cohort’s facilitation and coaching, transformation happens. Here are just a few of the remarkable results from last year’s cohort:

- Lutheran Social Services of New York witnessed a 13% decrease in the length of stay for Black youth in foster care, demonstrating their commitment to addressing disparities.

- Gemma Services’ (Pennsylvania) initiative to establish adolescent and father peer-support groups provided vital support to youth and families, empowering them to access resources, navigate systems and feel less isolated.

- Lutheran Child and Family Services of Illinois achieved a remarkable milestone with 72% of their foster youth successfully reunified with their families, a 50% improvement in the past year through a renewed dedication to strengthening families and emphasizing reunification rather than adoption or guardianship.

- Lutheran Social Services of Southern California implemented changes to electronic records and diligent search efforts to engage Black fathers and paternal resources which yielded positive outcomes.

One of the amazing elements of the Results Network cohort is the integration of peer leadership. In the most recent cohort, six diverse peer leaders were engaged to formally share their expertise, coaching and guidance.

The coming year of Results Network—which begins September 28—holds such high promise. Through a partnership with the Evangelical Lutheran Church in America (ELCA), we are thrilled to welcome grassroots, faith-based organizations and initiatives affiliated with an ELCA church or community to join, contribute and transform. Their courageous work and presence will deepen and expand the experiences, expertise and diversity of the Results Network, yielding unexplored results. I cannot wait to see what results emerge from this coming together of the Lutheran Services in America and ELCA communities!

If you are a grassroots, faith-based organization or initiative affiliated with an ELCA church or community that is interested in joining this year’s Results Network, please take a moment to learn more about participation and reach out to Renada Johnson, Senior Director of Child, Youth and Family Initiatives (rjohnson@lutheranservices.org).

Onward, together, with courage!

Kent Mitchell is the Vice President of Strategy and Innovation at Lutheran Services in America.